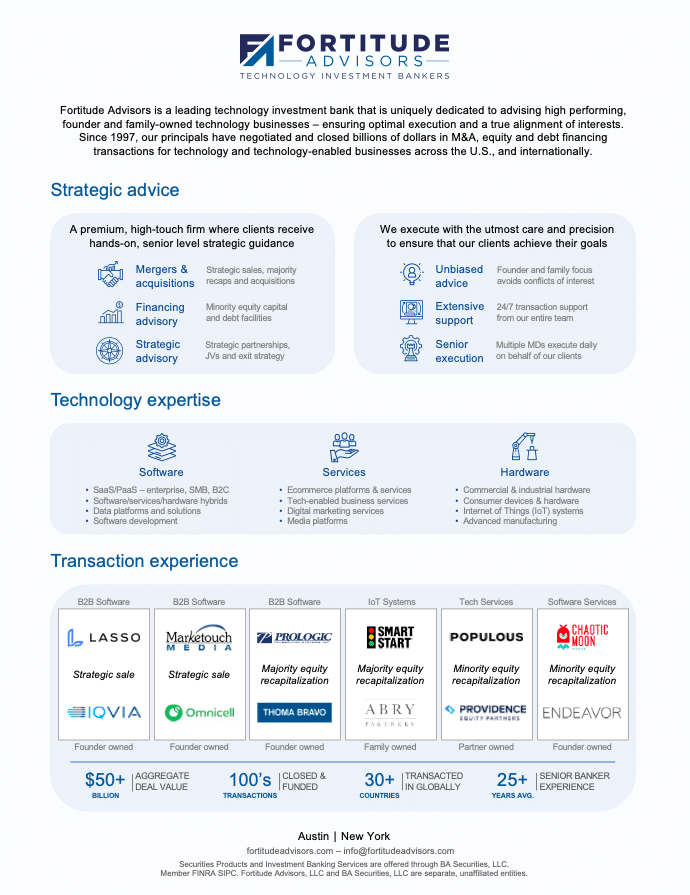

Services

Advisory services

We execute each transaction with precision and care, ensuring that our clients achieve their goals, while optimizing terms and valuation. Fortitude clients interact daily with our senior team and receive comprehensive transaction support from our junior bankers, from engagement through closing.

Mergers & acquisitions

Strategic sales, majority recaps and acquisitions

Financing advisory

Minority equity capital and debt facilities

Strategic advisory

Strategic partnerships, joint ventures and exit strategy

—Having dealt with many investment bankers over my career, the difference with Fortitude was night and day.

Fortitude’s unique model

Fortitude selectively partners with an exclusive group of clients who have built leading technology businesses. We invest extensive resources on behalf of every client to maximize their certainty of closing with the right strategic and financial partners, and under optimal terms.

-

Specialized advisors

Fortitude is an independent investment banking firm that is uniquely focused on serving the specialized needs of founders of leading technology businesses

-

Partnership approach

We work closely with each client to thoroughly prepare them for every step in the transaction process – providing them with unparalleled visibility, confidence and control

-

Unbiased advice

Our founder-oriented business model eliminates potential conflicts of interest with investors/buyers and optimizes negotiating leverage for our clients

-

Comprehensive diligence

The depth of our due diligence and analytics is unparalleled, and our firm is unique in funding critical third-party due diligence for our clients

-

Rigorous execution

Fortitude’s exceptional track record of successful closings is the result of a proven and proactive approach to controlling every step in the transaction process

-

Exclusive focus

We succeed by achieving our clients’ objectives – we embrace risk by partnering with a limited number of clients, ensuring alignment and a mutual incentive to succeed

-

Deep relationships

Our senior advisors personally execute every client mandate, bringing 25+ years of transaction experience and relationships with thousands of institutional investors

-

Investor perspective

Beyond relationships and access, we offer perspective on the culture, values and behavior of institutional investors – and valuable insight on their potential fit

-

Strategic process

Fortitude’s proprietary process and focus on strategic fit enhance negotiating leverage, certainty of closing and the likelihood of a successful partnership post-closing

—Having spent many years at traditional investment banking firms, the difference in Fortitude’s transaction process and results is astounding.